Palm oil producers have an additional advantage over their competitors of other vegetable oils due to the greater supply reliability. Production of vegetable oils from annual crops (like soybeans or rapeseed) are more susceptible to weather conditions. As against this, the oil palm is a perennial crop and is generally less affected by adverse weather conditions. First harvesting can take place approximately three years after planting and it can be done until 20-25 years of age. The optimal time for replanting depends on the variety, the land and the yield performance of the oil palm.

World Production of Oils & Fats and Rising Importance of Palm Oil

The world production of the major 17 oils & fats increased sharply from 103.1 million tonnes in 1998 to 154 million tonnes in 2007, representing an average annual growth in production of approximately 4.3%. Most of the growth in world production occurred in vegetable oils with an average annual increase of 4.9% during the past 10 years. Production of animal oils/fats (butter, lard as well as tallow) increased moderately by 1.9% per annum. Production of fish oil even declined slightly by 1.2%.

Among the 13 vegetable oils, palm oil showed the largest increase during the past 10 years by 7.9% per annum. Soya oil is in the second place with an average annual growth of 5.9% for the same period. Rape oil production (including canola oil) increased by 4.7% per annum for the same period. The increase in palm oil was due to several factors namely limited expansion opportunities of other vegetable oils and animal oils/fats and market price signals accelerated the growth in plantings and production of palm oil. Palm oil producers in Southeast Asia, primarily Indonesia, responded and this has been reflected in a steep increase in new plantings of oil palm trees in many parts of Indonesia since about 2001. The total area planted with oil palm trees has approached 6.7 million hectares as of end 2007. Significant additional expansion in new plantings is needed in coming years to generate the additional quantities required to satisfy prospective world consumption in the years to come.

Demand for Oils and Fats

Demand for Oils and FatsThe world’s consumption of the major 17 oils and fats has increased substantially during the past four years and is expected to continue growing very sharply in 2008 and 2009. World consumption increased from 103.2 million tonnes to 154.7 million tonnes from 1998 to 2007.

The main driving factors for the ever-increasing consumption demand are as follows :

(a) Increasing demand for food per capita, primarily in those countries in Asia as well as in Central & South America where economic activity is strong and average per capita usage levels still relativelylow;

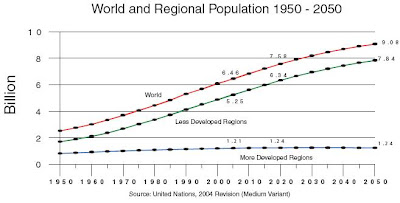

(b) Increasing population (primarily in the developing countries); and

(c) Additional demand for non-food applications i.e. (oleochemicals, compound feed and biofuels)

Over the last decade, consumption of vegetable oil has increased at the expense of other oils and fats. Increasingly, food manufacturers have been using vegetable oils as a substitute for animal oils becausethey contain lower cholesterol levels. In addition, there has been some concern regarding the off-take ofsaturated fatty acids, of which animal fats contain a higher proportion than most vegetable oils.

Over the last decade, consumption of vegetable oil has increased at the expense of other oils and fats. Increasingly, food manufacturers have been using vegetable oils as a substitute for animal oils becausethey contain lower cholesterol levels. In addition, there has been some concern regarding the off-take ofsaturated fatty acids, of which animal fats contain a higher proportion than most vegetable oils. Overall, Asia accounted for approximately 47% of worldwide oils and fats consumption in 2007. Annual per capita consumption of oils and fats is still relatively low in Asia, but has shown considerable increases over the past ten years in the major consuming countries, primarily China, Pakistan, Indonesia and India. In 2007, per capita consumption in most Asian countries was still considerably trailing the world average of 23.2 kilograms, thus indicating the potential for continued growth in this region. China and India are the most populous countries and in 2007 accounted for 37% of world population. The future expansion in demand of vegetable oils will be significant in Asia, owing to the rising population and increasing per capita usage, particularly if economic growth remains strong (as was the case in the latest five years).

The table illustrates per capita consumption of oils and fats in Indonesia, the United States, the European Union and certain countries for the years 1998 and 2007 according to information provided by Oil World. It should be noted that per capita consumption includes the use of oils and fats for food and non-food purposes (feed, oleochemicals and for biofuels from 2006).

No comments:

Post a Comment